On December 1, 2025, Shenhuo Corporation (stock code: 000933) issued a heavyweight announcement, announcing that the company will increase its capital by 1 billion yuan in cash to its wholly-owned subsidiary Shenhuo New Materials. This move aims to further strengthen the subsidiary’s financial strength, increase its aluminum processing business layout, and enhance its overall core competitiveness.

The announcement shows that the capital increase plan has been reviewed by the company’s board of directors. On December 1st, Shenhuo Co., Ltd. held the 23rd meeting of the 9th board of directors to vote on the proposal to increase capital to its wholly-owned subsidiary Shenhuo New Materials. The plan was ultimately approved by a unanimous vote of 9 in favor, 0 against, and 0 abstentions, and the capital increase plan was finalized.

From the nature of the transaction, this capital increase does not have any related party transaction attributes, nor does it constitute a major asset restructuring as stipulated in the “Management Measures for Major Asset Restructuring of Listed Companies”, nor does it involve restructuring and listing. It will be steadily promoted in accordance with relevant procedures in the future.

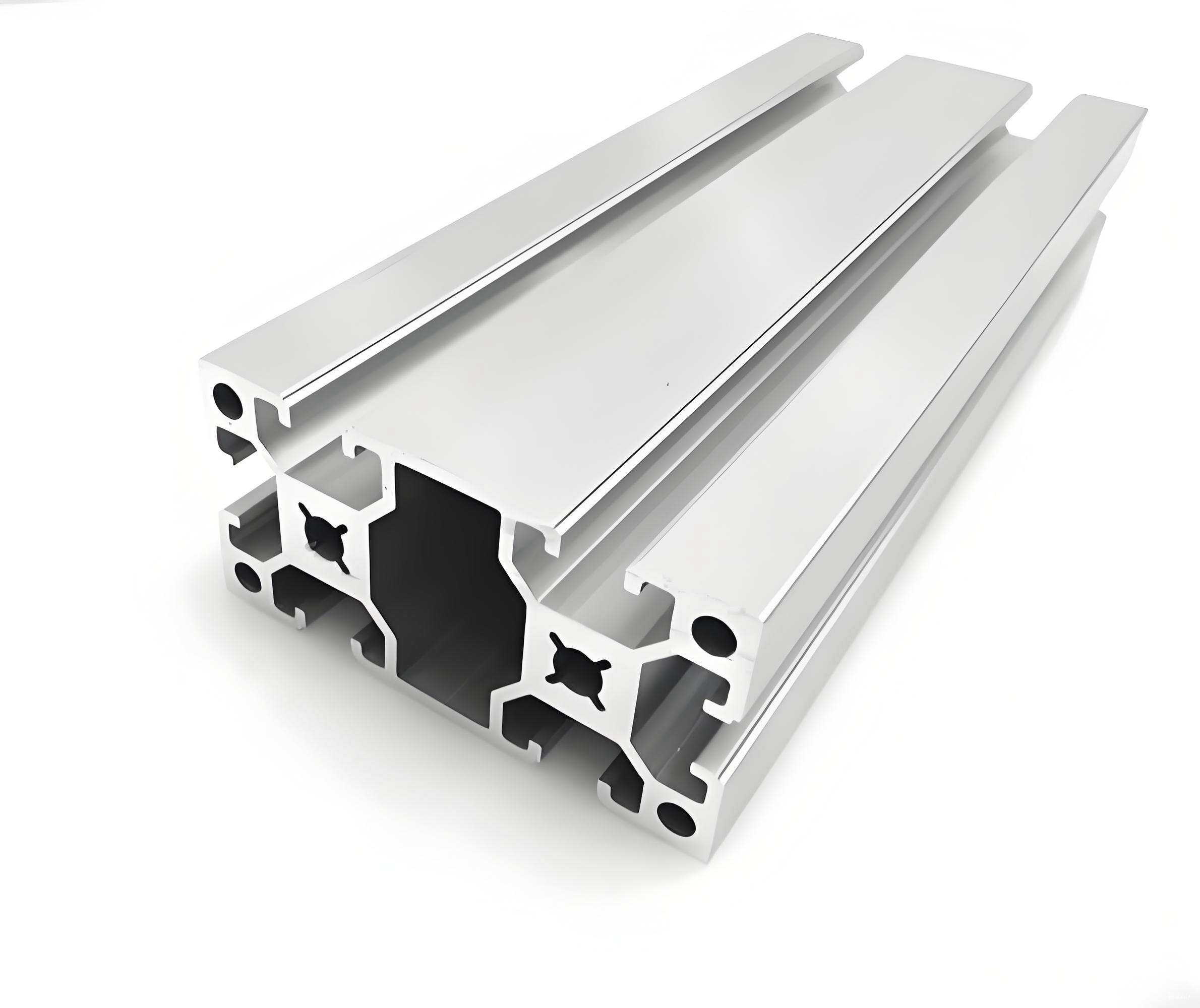

For the core purpose of capital increase, Shenhuo Group clearly stated in the announcement that the 1 billion yuan cash injection will directly enhance Shenhuo New Materials’ capital reserves and provide solid financial support for the improvement of its aluminum processing business industrial layout. In the long run, this move will help further consolidate and enhance the company’s position in the market for aluminum processing products, strengthen brand influence, and simultaneously enhance the sustained profitability and core competitiveness of Shenhuo Group and its subsidiary Shenhuo New Materials, helping the enterprise achieve its overall high-quality development goals.

Public information shows that as the core platform of Shenhuo Group, which focuses on aluminum processing business, the business development of Shenhuo New Materials has a significant impact on the overall industrial chain layout and profitability of the parent company. This large capital increase has been interpreted by the market as a clear signal for Shenhuo Group to focus on its main business of aluminum processing and increase its core business development, which is expected to inject new impetus into the company’s future performance growth.

Post time: Dec-12-2025