Against the backdrop of gradual global industrial recovery, the International Aluminium Institute (IAI) recently released its monthly production report, revealing a steady performance in the global primary aluminum sector for October 2025. Data shows that global primary aluminum output reached 6.294 million metric tons last month, registering a modest year-on-year (YoY) increase of 0.6%. On a daily average basis, production stood at 203,000 metric tons, reflecting consistent operational stability across major producing regions.

Notably, China the world’s largest primary aluminum producer, maintained its dominant position in global supply. The country’s estimated primary aluminum output in October reached 3.766 million metric tons, accounting for nearly 60% of the global total. This figure underscores the effective release of China’s compliant production capacity, supported by optimized industrial policies and advanced energy saving technologies in key aluminum producing hubs such as Xinjiang and Guangxi. The stable output from China has played a pivotal role in mitigating potential supply volatility in the global market.

In contrast, North America’s primary aluminum output in October stood at 334,000 metric tons. While the region’s production remained consistent month-on-month, it continues to face constraints from high energy costs, particularly in regions dependent on natural gas for smelting. This dynamic highlights the uneven recovery pace across global aluminum-producing markets, with cost competitiveness emerging as a key differentiator for sustained output growth.

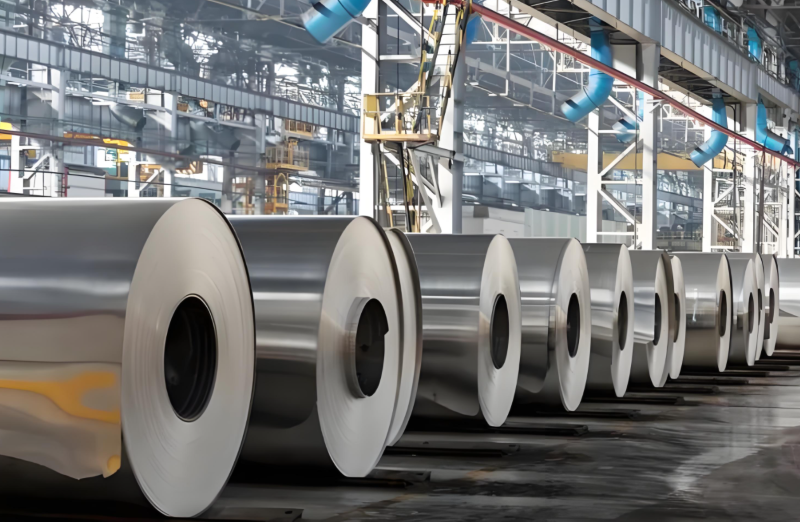

For downstream aluminum processing sectors, including manufacturers of aluminum sheets, extruded aluminum bars, aluminum tubes, and precision machined aluminum components, the steady global primary aluminum supply translates to enhanced supply chain resilience and more predictable cost structures. As end user industries such as automotive, construction, and electronics ramp up demand, the stable upstream output provides a solid foundation for processing enterprises to optimize production schedules and meet client specifications.

Looking ahead, industry analysts anticipate that global primary aluminum output will maintain a moderate growth trajectory, driven by incremental capacity additions in emerging markets and ongoing efficiency improvements in mature producers. This trend is expected to support balanced supply-demand dynamics in the aluminum value chain, benefiting both upstream smelters and downstream processing businesses in the coming quarters.

Post time: Nov-26-2025