The International Aluminum Association (IAI) has released global primary aluminum production data for August – the data shows that the global primary aluminum production in August 2025 was 6.277 million tons, compared to 6.222 million tons in the same period last year, and the revised value for the previous month was 6.268 million tons. It is expected that China’s primary aluminum production in August will be 3.764 million tons, with a revised value of 3.764 million tons from the previous month.

On September 23, 2025, according to data from Changjiang Nonferrous Metals Network, the comprehensive green electricity aluminum price in Changjiang was reported at 21040 yuan/ton, a decrease of 70 yuan/ton from the previous trading day.

From the supply side, the growth rate of global primary aluminum production remains low, and China’s production capacity has a significant “peak” feature. According to IAI data, global primary aluminum production in August only slightly increased by 0.14% compared to the revised value in July (6.268 million tons). As the world’s largest producer (accounting for about 60%), China’s production in August remained the same as the previous month at 3.764 million tons, reflecting that the domestic electrolytic aluminum operating capacity has approached the policy red line of 45 million tons, and the space for releasing new production capacity is extremely limited.

In terms of overseas supply, due to high energy costs, Europe has only achieved 30% of its planned production capacity for the first half of 2025; Although Indonesia plans to add 1.7 million tons of production capacity by 2030, the actual production progress is delayed by about 4 months due to the delayed ESG review of self owned coal-fired power plants.

On the demand side, there is a differentiation pattern of strong support for new energy and weak recovery in traditional fields. The new energy track has become a core increment: According to data from the China Photovoltaic Industry Association, from January to August 2025, the newly installed photovoltaic capacity in China increased by 58% year-on-year, driving a 42% increase in aluminum consumption for photovoltaic frames and brackets; In the field of new energy vehicles, production and sales increased by 35% year-on-year from January to August, and the amount of aluminum used per vehicle (about 200 kilograms) was 15% higher than that of traditional fuel vehicles, driving a 28% increase in demand for transportation aluminum.

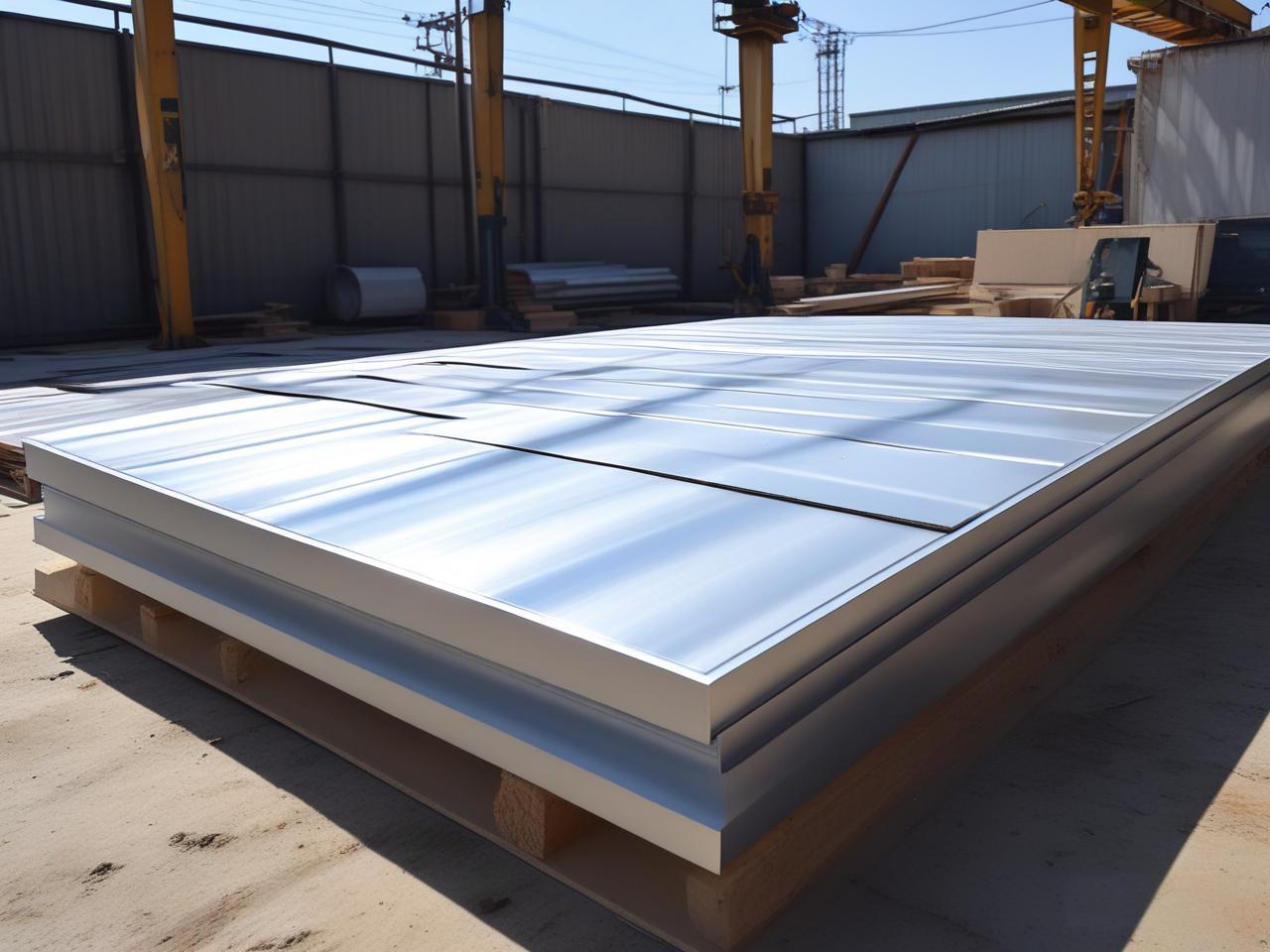

At the market level, the linkage effect between spot prices, inventory, and markups is becoming increasingly significant. China is accelerating its transformation towards high value-added products (such as aluminum sheets, strips, and foils) due to the cancellation of the aluminum export tax rebate policy. In July, the proportion of high-end product exports has increased, offsetting the impact of the decline in low-end profile exports.

In the future, aluminum prices may continue to fluctuate and adjust in the short term. The spot market still faces downward pressure due to seasonal weak demand, but there is strong support below. In the medium to long term, if the production progress of Indonesia’s green aluminum project falls short of expectations or the global new energy installed capacity grows beyond expectations, aluminum prices are expected to exceed 23000 yuan/ton and return to the valuation center of “new energy metals”. For industrial chain enterprises, strengthening cost control and laying out high-end processing (such as battery foil and car body panels) will be the core strategy to cope with fluctuations and seize dividends.

Post time: Sep-25-2025