China’s aluminum industry presented a complex trade picture in November 2025, characterized by robust raw material imports but persistent challenges for finished product exports, according to the latest data from the General Administration of Customs. These trends highlight evolving dynamics with significant implications for domestic fabricators and processors.

The most striking figure remains the substantial inflow of bauxite (aluminum ore). November imports surged to 15.11 million metric tons, a significant 22.9% year-on-year increase. This brings the cumulative volume for January-November to a substantial 185.96 million tons, up 29.4% year-on-year. This relentless growth underscores China’s continued heavy reliance on imported raw materials to feed its vast primary aluminum smelting capacity, driven by both domestic demand and strategic stockpiling considerations.

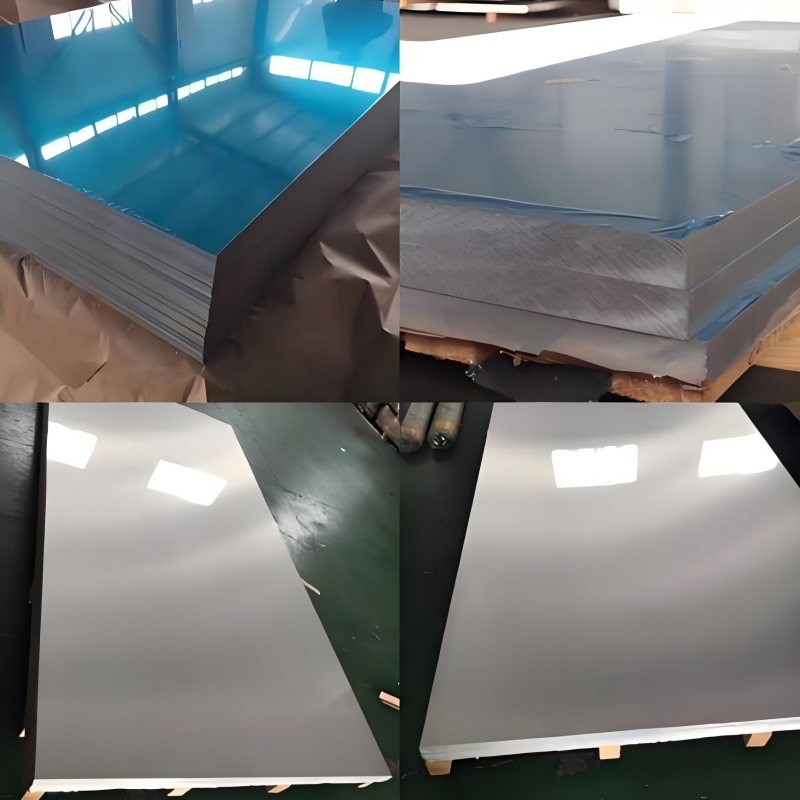

Conversely, exports of unwrought aluminum and aluminum semis (including plates, sheets, rods, bars, tubes, and profiles) faced sustained pressure. November shipments totaled 570,000 tons, marking a 14.8% decline compared to the same period last year. The year-to-date figure stands at 5.59 million tons, reflecting a 9.2% decrease. This ongoing contraction points to several factors, including subdued global manufacturing demand, persistent trade barriers (like tariffs and quotas), and increased competition from other global producers. Alumina exports also dipped in November (170,000 tons, down 12.2%), although the cumulative January-November volume remains robust at 2.34 million tons, showing strong growth of 46.7% year-on-year, indicating sustained international demand for this intermediate product.

On the import side for finished products, November saw 240,000 tons of unwrought aluminum and semis enter China, down 14.0% year-on-year. However, the cumulative January-November imports reached 3.60 million tons, still reflecting a modest 4.4% increase. This suggests that while monthly flows fluctuate, underlying demand for specific high-quality or specialized aluminum products within the Chinese market remains resilient.

While China’s aluminum sector navigates export headwinds for finished goods, the strong bauxite imports signal sustained primary production. The opportunity lies in domestic value addition. Fabricators offering advanced CNC machining, custom extrusion cutting, and bespoke fabrication services for aluminum plate, rod, and tube are crucial in translating raw material strength into high-value components for domestic industrial consumption. The ability to meet exacting dimensional and performance requirements is key to thriving in this evolving landscape.

Post time: Dec-19-2025